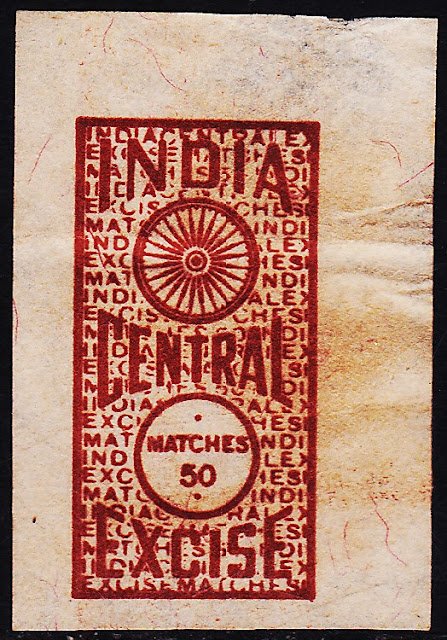

Understanding the India Central Excise Label

The India Central Excise Label is a critical component for businesses operating within the framework of the Indian taxation system. Designed to meet the requirements set forth by the Central Board of Indirect Taxes and Customs (CBIC), this label ensures that manufacturers and service providers comply with the regulations pertaining to excise duties. By using this label, businesses can demonstrate their adherence to regulatory standards, fostering trust and reliability among consumers.

Key Features of the India Central Excise Label

Our India Central Excise Label comes equipped with several features tailored to enhance both security and authenticity. These labels are made from high-quality materials that resist damage and tampering, ensuring that the excise duty status of your products remains clearly visible. With a design that facilitates easy application, these labels can be affixed to various products and packaging seamlessly. Furthermore, the incorporation of unique serial numbers aids in tracking and record-keeping, essential for auditing and compliance processes.

Importance of Compliance and Accurate Labeling

Ensuring compliance with India’s excise regulations is not just a legal obligation but also plays a significant role in bolstering your brand’s reputation. The use of the India Central Excise Label signifies your commitment to transparency and accountability. This is particularly crucial in industries subject to rigorous regulations, as it can mitigate the risk of penalties and foster a culture of ethical business practices. Investing in proper labeling isn’t merely a compliance measure; it’s a step towards building consumer confidence and loyalty.

Reviews

There are no reviews yet.